That time of year has arrived again. How will you balance your finances in 2026?

With New Year’s Day falling on a Thursday in 2026, many people will not resume work until Monday 5 January. In theory, that leaves you plenty of time to recover from New Year’s Eve indulgences, if necessary, and contemplate New Year’s resolutions. To help you with the latter, here are half a dozen financial resolutions to ponder:

1. Get a will or, if you have one, make sure it is up to date: If you die without a will, the rules of intestacy take over. These may be appropriate if you are a married couple with 2.1 children, but even then, they may not produce the result you would want. Equally, an out-of-date will could mean your wishes are not met.

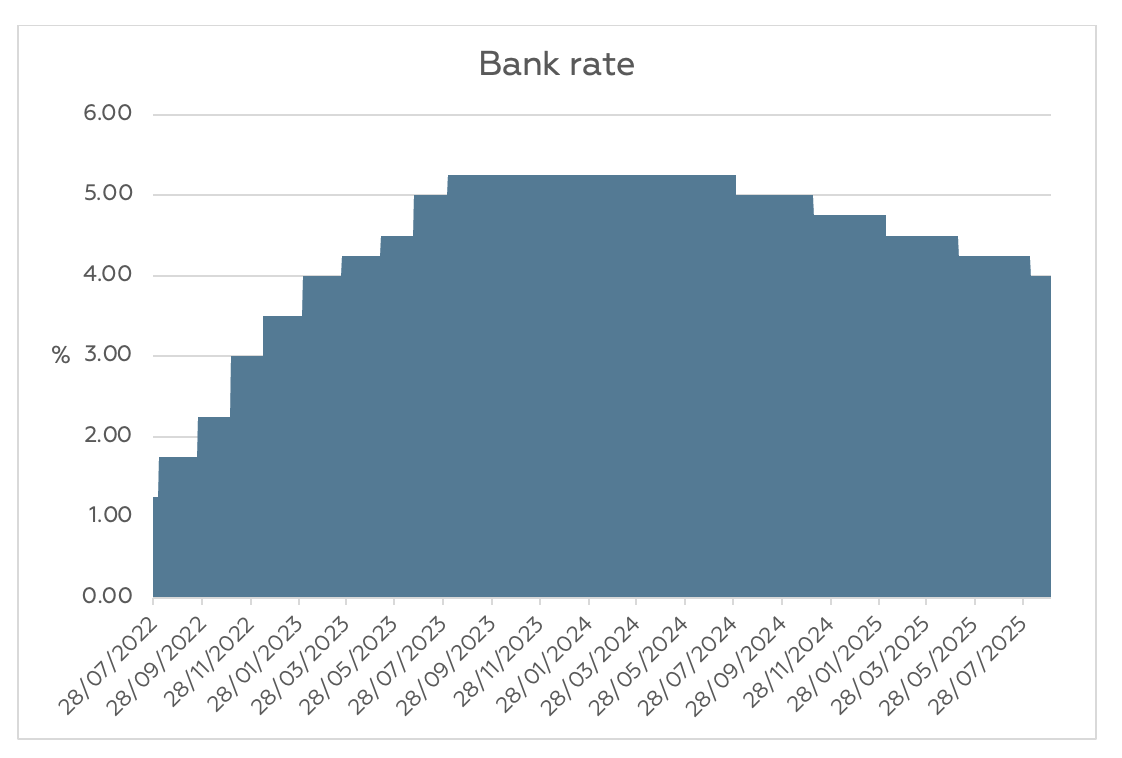

2. Do not ignore that Christmas credit card debt: Most credit card debt is expensive – even a high street bank card could be charging 25% interest, with store cards often charging more. You cannot earn 5% on your savings, so it will usually be better to pay down the debt than save.

3. Have a trawl through your bank statements: You could find that annual subscription that you either forgot you had signed up for, or discover a monthly cash drain triggered by clicking the wrong button when internet shopping.

4. Make a note of the renewal dates for your household insurance policies: Insurance companies would prefer that you renew their policies automatically. If you know when renewal is due, you can check the market beforehand and be ready to switch (or haggle).

5. Check the interest rate you are earning on your cash savings: Banks and building societies frequently pay a higher interest rate to attract new savers than they offer to loyal customers. The new saver bait can include time-limited bonus rates: you probably need to leave when the bonus expires.

6. Consider switching to a fixed rate deal for your energy bills: 1 January will mark the start of a new Ofgem quarterly price cap for gas and electricity prices. If you are still on the standard variable tariff – which most people were after the 2022/23 energy crisis – you could save money and avoid the three-monthly tariff roller-coaster with a fixed rate offer.

The Financial Conduct Authority does not regulate will writing.