The case for holidays for investors

August started with sharp gyrations on global stock markets. It was a good time to be on holiday.

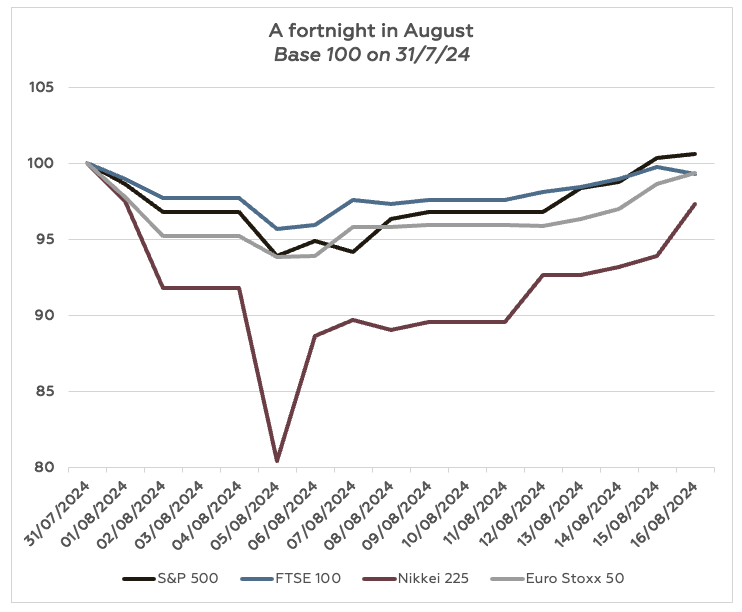

Source: Investing.com

It was once suggested that a wise approach to investment in the stock market is to make your choice and then go away to a remote desert island with no communication links for at least three – or preferably five – years. This drastic prescription, which predates the internet era, was meant to stop the investor from watching markets day-to-day, worrying about any temporary falls and making changes that would later prove ill-judged. The logic underpinning the recommendation remains true today: investment in shares is for the long term and what happens in the short term is often best ignored as nothing more than noise.

In a much shorter timeframe, if you went on holiday for the first half of August 2024, you could have experienced something very similar (provided you resisted the temptation to look at your phone). The first two days of August were consecutive days of disappointing employment data from the US. The double punch prompted concerns that the US economy was headed for a recession, even though it had grown at a healthy annualised rate of 2.8% in the second quarter of 2024. The second set of employment figures showed the US had created 114,000 new jobs in July, which was much lower than expected but higher than the (revised) figure for April. Unfortunately that figure emerged on a Friday, giving those prone to panic the chance to spend the entire weekend fretting that the US economy was about to crash, dragging the world economy with it.

On Monday 5 August, amid speculation that the US Federal Reserve would have to make an emergency rate cut of at least 0.5%, the Japanese stock market (as measured by the Nikkei 225) collapsed by over 12%. On the following day, there was a change of heart and the Japanese market rose by over 10%. Thereafter, a calmer mood prevailed, aided by better US employment data on Thursday 8 August. As the graph shows, by Friday 16 August the US market (represented by the S&P 500) was higher than at the end of July and Japan was down, but by less than 5%.

As a lesson in ignoring the noise in favour of the beach, it could not have been a better example…

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.